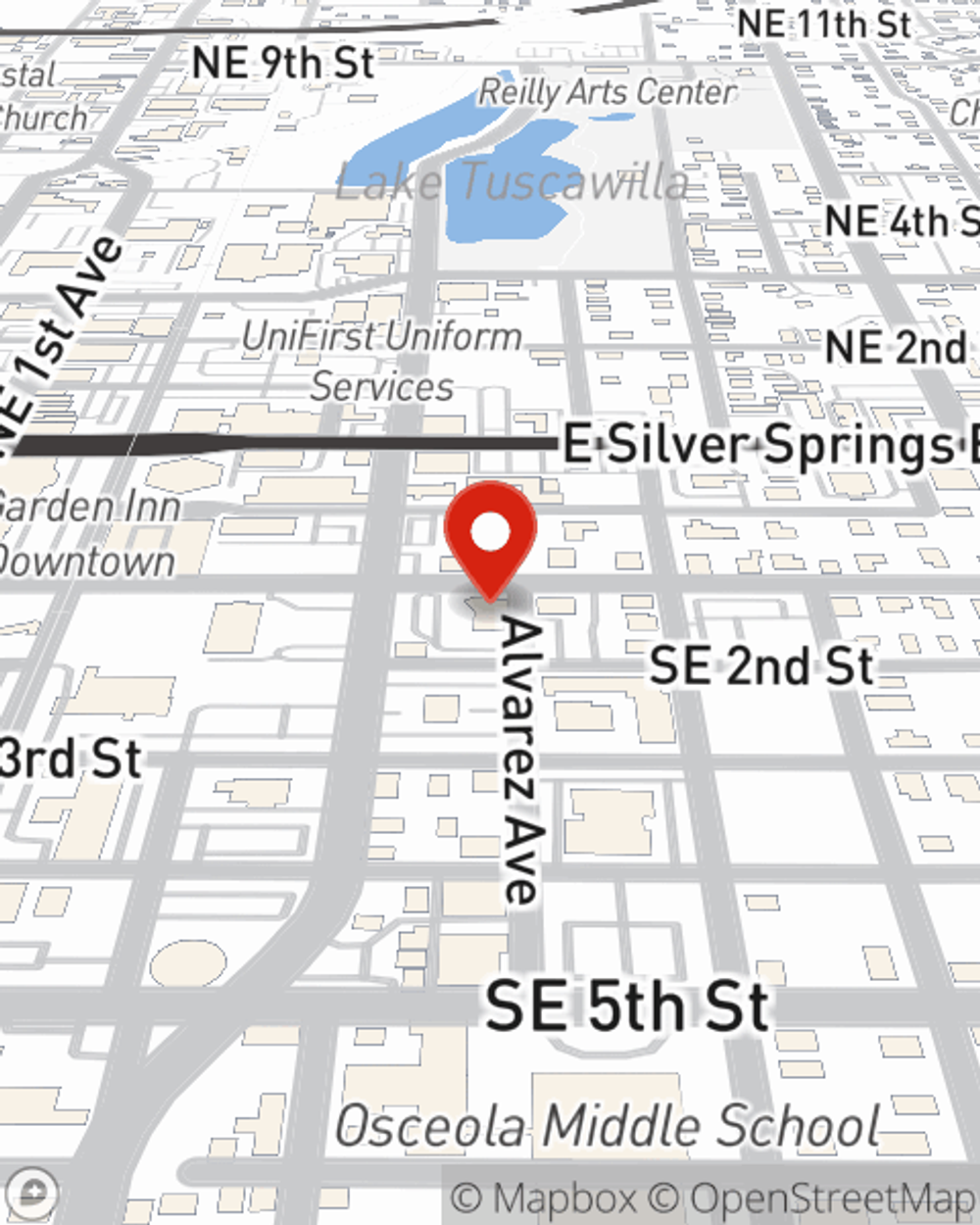

Business Insurance in and around Ocala

Calling all small business owners of Ocala!

No funny business here

- Orlando

- Gainesville

- Tampa

- Clermont

- Belleview

- Dunnellon

- Leesburg

- Mount Dora

- Crystal River

Your Search For Remarkable Small Business Insurance Ends Now.

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide quality insurance for your business. Your policy can include options such as extra liability coverage, worker's compensation for your employees, and business continuity plans.

Calling all small business owners of Ocala!

No funny business here

Customizable Coverage For Your Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Angie Lewis for a policy that covers your business. Your coverage can include everything from errors and omissions liability or business continuity plans to commercial auto insurance or group life insurance if there are 5 or more employees.

Agent Angie Lewis is here to talk through your business insurance options with you. Reach out Angie Lewis today!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Angie Lewis

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.